If you use bookkeeping or accounting software, you can conveniently store one copy with the sale. Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. To make sure you have cash receipt accounting down pat, check out the cash received journal entry examples below. A cash receipts journal is a special journal within the general journal that is used specifically to record all the cash receipts. It has a total record of all the cash collections during an accounting period.

- Escrow property cannot be delivered toanyone, except in accordance with the provisions in the escrow agreement.

- This helps monitor and track the cash collected throughout a business’s cash transactions.

- A common example involves the down payment in the purchase and sale of aresidence, condominium or cooperative.

- You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day.

- They are an efficient way of keeping track of all the cash received during an accounting period.

- Examples would be the proceeds for loan payments, money for increased capital investment, and refunds from vendors.

Journal and Discounts Allowed

Keep in mind, the cash receipt process varies from business to business. You can tweak the above steps to better fit the workflow of your company. Awards from the fund are generally madeafter difference between horizontal and vertical analysis with comparison chart a lawyer’s disbarment, and where it appears that the lawyer is unableto make restitution. To qualify, theloss must occur in the practice of law, and in an attorney-clientrelationship.

Ask Any Financial Question

Assuring that every cash transaction made is posted to the appropriate account is important as well in order to keep information organized within the journal. Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit. Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit). As with other journals, the cash receipts journal is posted in two stages. Any entries in the accounts receivable column should be posted to the subsidiary accounts receivable ledger on a daily basis.

Example of a cash receipts journal with transactions

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A check is placed under the total of this column as this total is net posted. You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US).

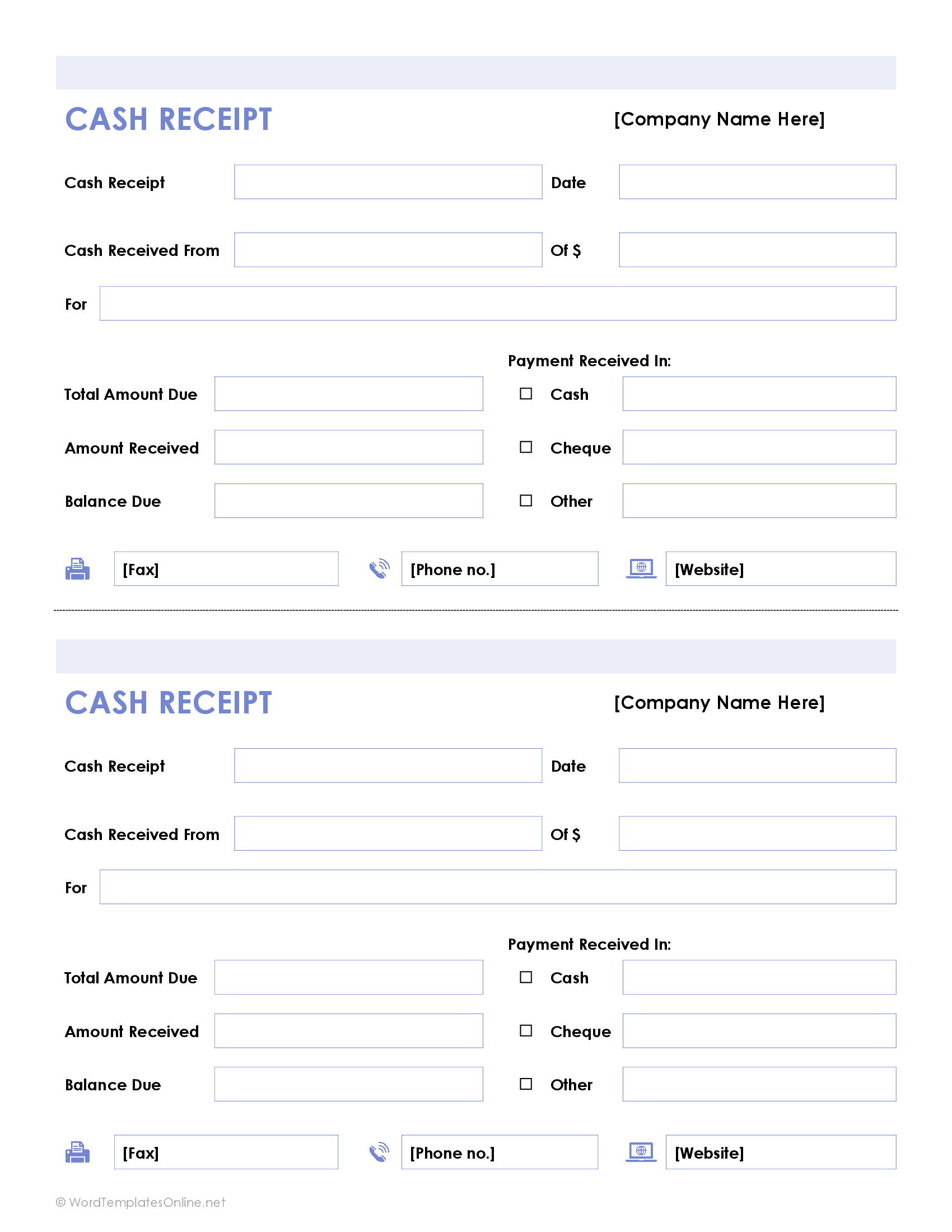

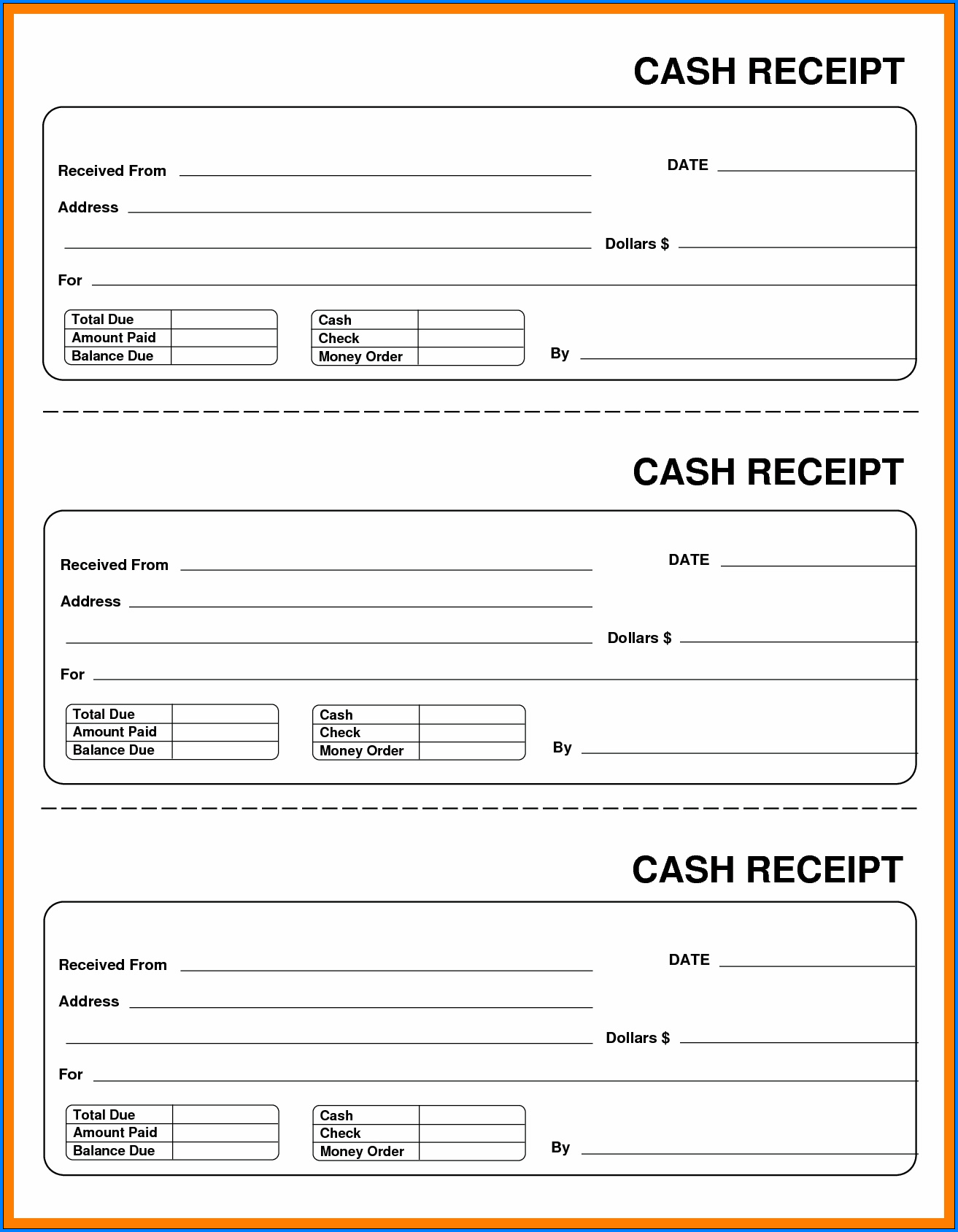

Record the cash receipt transaction

At a minimum, the transactions in the journal should be posted to the general ledger at the end of each reporting period, though posting may be conducted on a daily basis. In some cases, you might receive a check or cash payment from a customer later on. In these cases, you will need to make a separate cash received journal entry to record this information. You must also track how these payments impact customer invoices and store credit.

All interest that’s earned on an escrow deposit should be paid out inaccordance with the escrow agreement, or to the party whose money generatedthe interest. It would be a conflict of interest for an escrow agent, as afiduciary, to require that bank interest be treated as compensation forservices rendered. An escrow agent can have no claim or lien on the escrow deposit forservices rendered, unless the escrow agreement provides otherwise. Theescrow agent is simply a custodian of the escrow property, which must bepaid out as the escrow agreement provides. As previously mentioned, cash receipt journals record the inflow of cash from any source.

Cost of sales is also known as the cost of goods sold, and the two terms are used interchangeably. Generally in the cash receipts journal to debit columns for cash receipts and cash discount and three credit columns for accounts receivable, sales and other accounts are there. Cash received from various sources other than cash sales and account receivables are recorded in other accounts column.

The cash receipts journal would cover items like payments made by customers on an unpaid accounts receivable account or cash sales. Whereas the cash disbursement record would include items like payments made to vendors to lower accounts payable. Typically cash receipt journals are used by corporations to record the money they have collected. These transactions include cash transactions, acquiring funds through a loan, payments through customer accounts or sale of assets. When a customer purchases inventory on credit, the sale isn’t directly recorded in the cash receipts journal because no cash has actually been collected.

Let’s say, for example, you have a retail business that sells t-shirts called BigT. The following are business transactions and how they would be posted into the cash receipts journal. A cash receipt should be generated whenever you receive cash from an external source and record an increase to your cash account on the balance sheet.