All cash transactions made during an accounting period are documented in a cash receipts journal, which is set up as a subsidiary of the general ledger. Chronological entries are made in the cash receipts journal and the balance is continuously updated and confirmed. The cash receipt journal has many advantages about its use within regular business accounting methods. A cash receipts journal provides an easy and organized way to record all the cash receipts during the period. Therefore, it allows a quicker and accurate way to prepare the cash ledger and a cash flow statement for the business for an accounting period.

How are the totals from the different columns in a cash receipts journal posted to general ledger accounts?

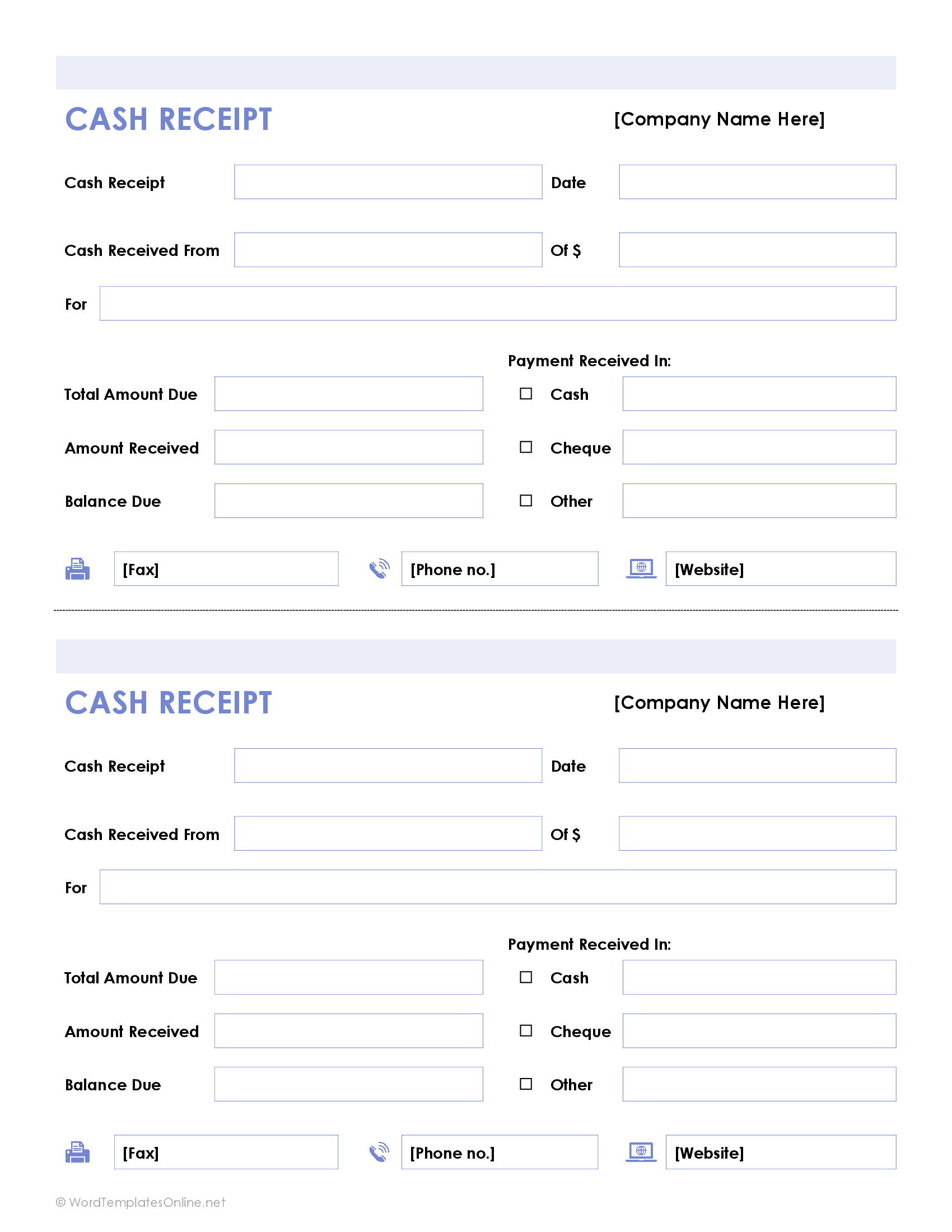

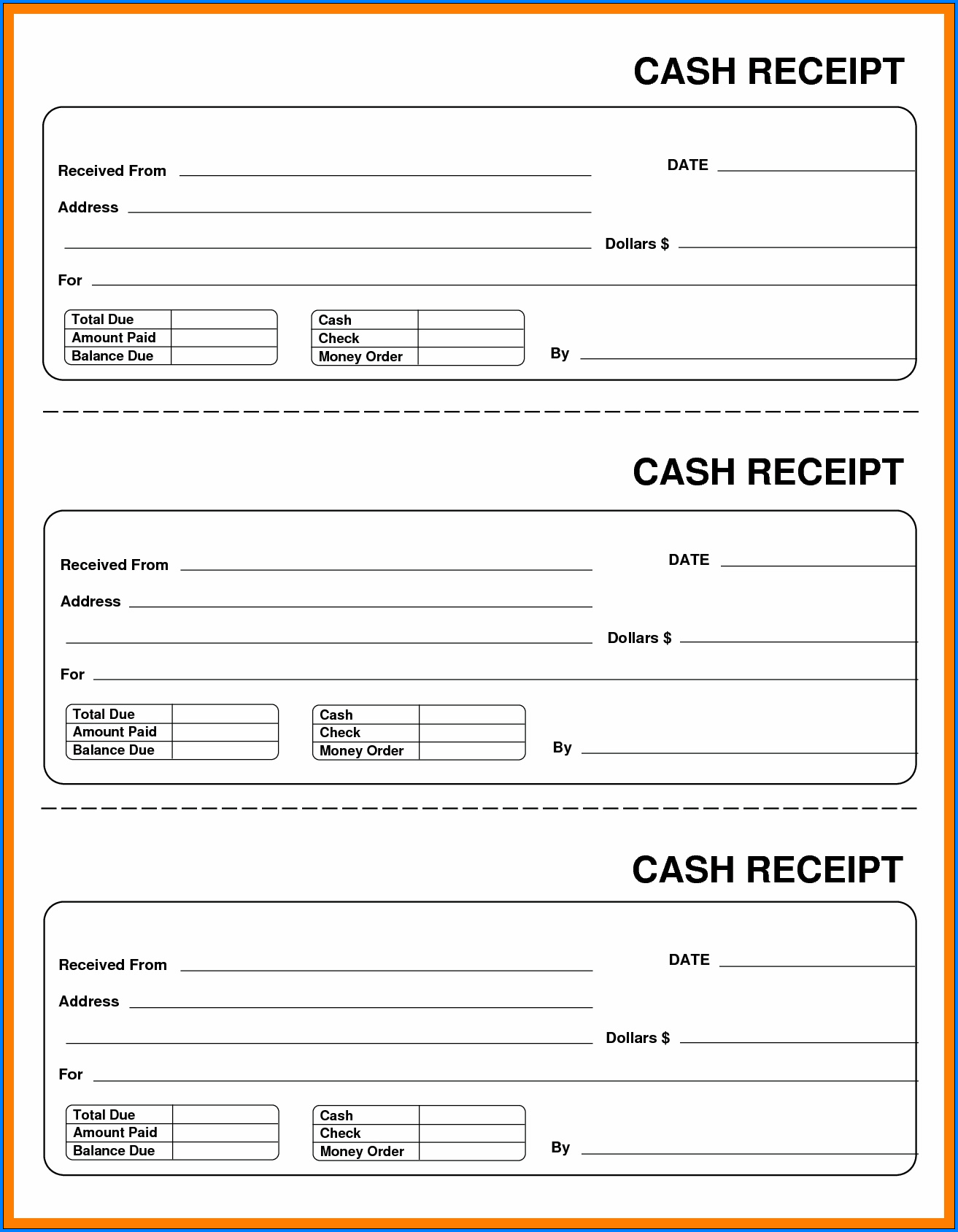

A proposal for operation development pod is used to record all cash receipts of the business. You calculate your cash receipts journal by totalling up your cash receipts from your accounts receivable account. As an accounting entry that records the receipt of money from a customer, a cash sales receipt is a debit.

- It should be kept for income tax reporting purposes and to support your financial statements.

- Keeping track of your business’s cash receipts in a timely manner is necessary for efficient financial management.

- Because escrow agreements are legal contracts that involve important rightsand obligations, the careful consumer will consult a lawyer beforeentrusting money or property with an escrow agent.

- Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price.

Posting Cash Receipts Journal to Ledger Accounts

If you lose one or more cash sales receipts, it may be difficult to have an accurate balance sheet because the cash account will be incorrect. An inaccurate balance sheet can lead to underestimation of business expenses and inflation of profit and revenue. This can be financially damaging to your business due to potential overspending and overestimating cash flow among other issues. The balance in the cash receipts journal is regularly summarized into an aggregate amount and posted to the general ledger.

What is a common error made when posting entries from a cash receipts journal?

Additionally in some businesses, the cash receipts journal is combined with the cash disbursements journal and is referred to as the cash book. Not in all cases, but escrow agreements should require interest-bearingaccounts when escrow funds can generate significant interest for one or moreof the parties. For small and short-term escrow deposits, lawyers arepermitted by state law to use so-called “IOLA Accounts”. Interest earned onthese IOLA accounts is pooled and used to finance civil legal services forthe poor. A cash disbursements journal is the counterpart to the cash receipts journal.

And, enter the cash transaction in your sales journal or accounts receivable ledger. All cash receipts for a given accounting period are recorded in the cash receipts journal, a special kind of accounting journal. Cash receipts, on the other hand, serve as documentation of a cash sale from the cash received for your company.

Step 8. Accounts receivable

This journal is used to offload transaction volume from the general ledger, where it might otherwise clutter up the general ledger. The cash receipts journal is most commonly found in manual accounting systems. The concept is essentially invisible in many accounting software packages.

Journals are the foundation and an important part of the accounting process. They contain detailed records of business transactions and are used for reconciling accounts and transferring information to other accounting records. These records can include transaction amount, account name, receivable ledger, receivable account, and more. When a company receives a loan from a bank, a transaction is performed in the cash sales collections journal to record the loan. The main objective of a cash receipts journal is to properly manage cash by making it simple to ascertain cash balances at any given time, enabling managers and corporate accountants to budget their cash. Regularly, an overall sum of the journal balance is calculated and sent to the general ledger.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.